Markets were buoyed last week by the drop in longer-term (5-year) consumer inflation expectations in the US (Michigan). Stocks could rally because the Fed would not be so aggressive on…

At the current juncture, these are the critical points: 1) The June CPI report was a shocker. The Fed is hiking into a rapidly slowing economy because inflation was allowed to…

The dip in 10-year US Treasury yields (back below 3%) looked set to take the pressure off Governor Kuroda and the BoJ for a while. But the yen is hitting…

Markets paid a lot of attention last week to the first German trade deficit since 1991 (seasonally adjusted): the euro slumped. Higher energy import costs and a loss of competitiveness…

The semiconductor cycle is turning and, with it perhaps, the short, sharp period of durables inflation experienced globally over the last two years. Shortages in the semiconductor industry will soon…

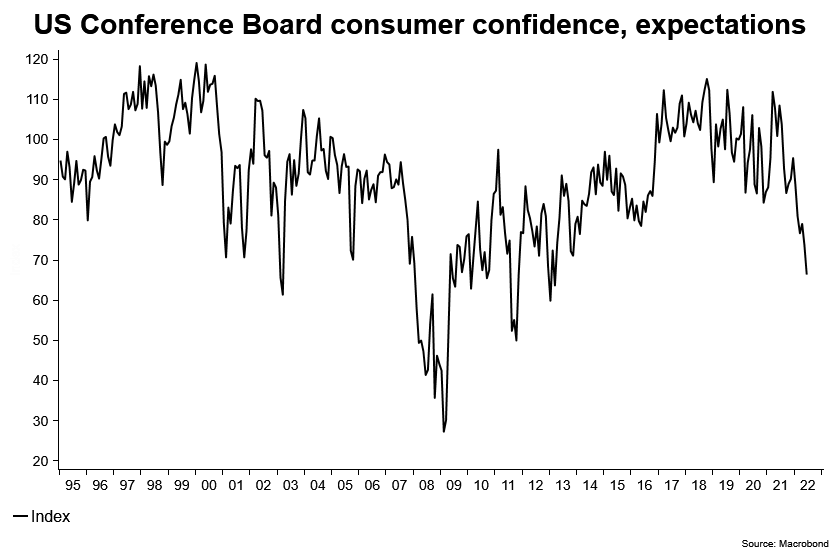

Consumer spending is now weakening in the US, as inflation takes its toll. The Conference Board’s expectations index for consumer confidence is finally catching up to the slide in the…

The easing of Covid-19 restrictions in China cannot mask the assault on individual liberties. Under the cover of the pandemic, the Chinese authorities are exerting greater control over the population…